Whether you're a church treasurer or a new pastor, understanding the ins and outs of church donation receipts is essential.

These receipts not only serve as a token of gratitude from your church but also play a pivotal role in tax benefits and compliance.

In this post, we delve into the intricacies of this often-overlooked aspect of church financial management. From the crucial elements of a proper receipt to how it impacts your members, we provide you with a comprehensive resource to navigate the world of church donations and ensure your contributions make a meaningful difference.

A donation receipt is a document that a church or nonprofit organization provides to donors to acknowledge and confirm a donation they have made. It's also an opportunity to thank your supporters and encourage more donations.

Sometimes a donation receipt is called a.

Whatever name your church calls it, it is the document you send to your donors and supporters to thank them for their contribution and that they can use when filing their taxes.

Your members need written proof of their donations in order to claim them on their tax return. Without a donation receipt, they cannot file their generous support during tax season in exchange for the donation.

It's also important to let your donors know that you don't take their support for granted. Giving them a letter that thanks them for their support and details how your church used their money will go a long way to maintain their trust and support.

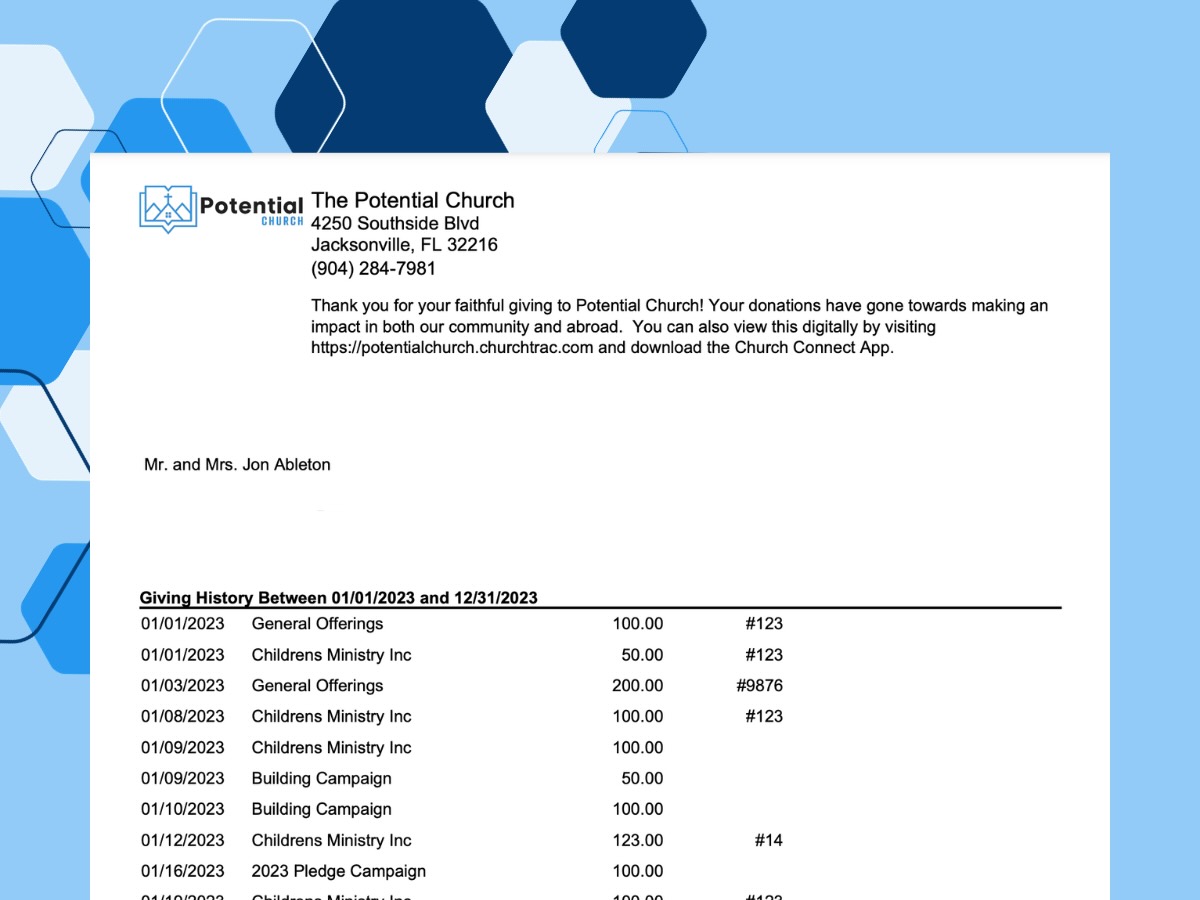

Every church is different. Your church may need to include information on the contribution statement that other churches don't. However, most churches will need to include a few items on their statements.

Here are the 5 things every donation receipt needs:

As long as you include these 5 things, your donors have what they need during tax season.

A nonprofit donation receipt is important because according to the IRS Publication 1771.

"Donors must have a bank record or written communication from a charity for any monetary contribution before the donors can claim a charitable contribution on their federal income tax returns."

The IRS leaves it up to donors to obtain this document. However, it's best for churches to produce these receipts for donors regardless if the donor requests it. That's because transparency and open communication with your donors is always a plus!

And it won't take more than a couple minutes of your time if you're using a church donation software like ChurchTrac! Donation receipts are created for you with just the click of a mouse.

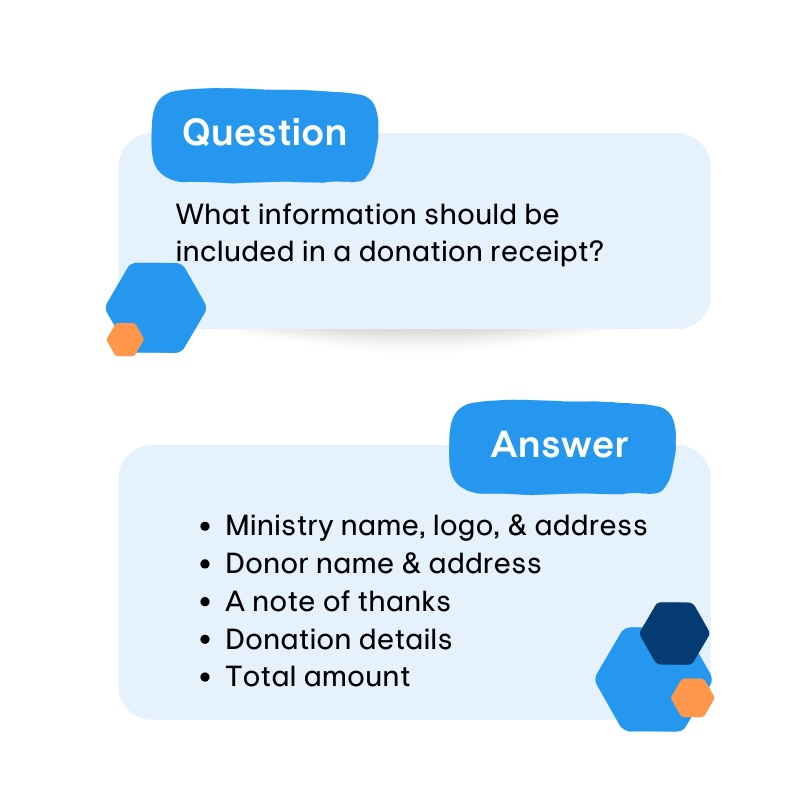

A cash donation is exactly what the name implies. It's a donation made with cash! Of course, this also includes donations made by check, debit card, or credit card.

An in-kind donation is simply any non-monetary donation. In other words, anytime someone gives the church tangible items like clothes, canned food, furniture, or gift cards, these must be recorded as in-kind donations.

To the donor, the main benefit of donation receipts is filing a tax deduction. So it's important for churches and ministries to make sure the donations are tax-deductible.

Below are the 9 things you need to do to make sure these receipts are tax-deductible:

Not every donation is tax-deductible, however. To learn more about how to determine if a donation is tax-deductible, watch the short video below!

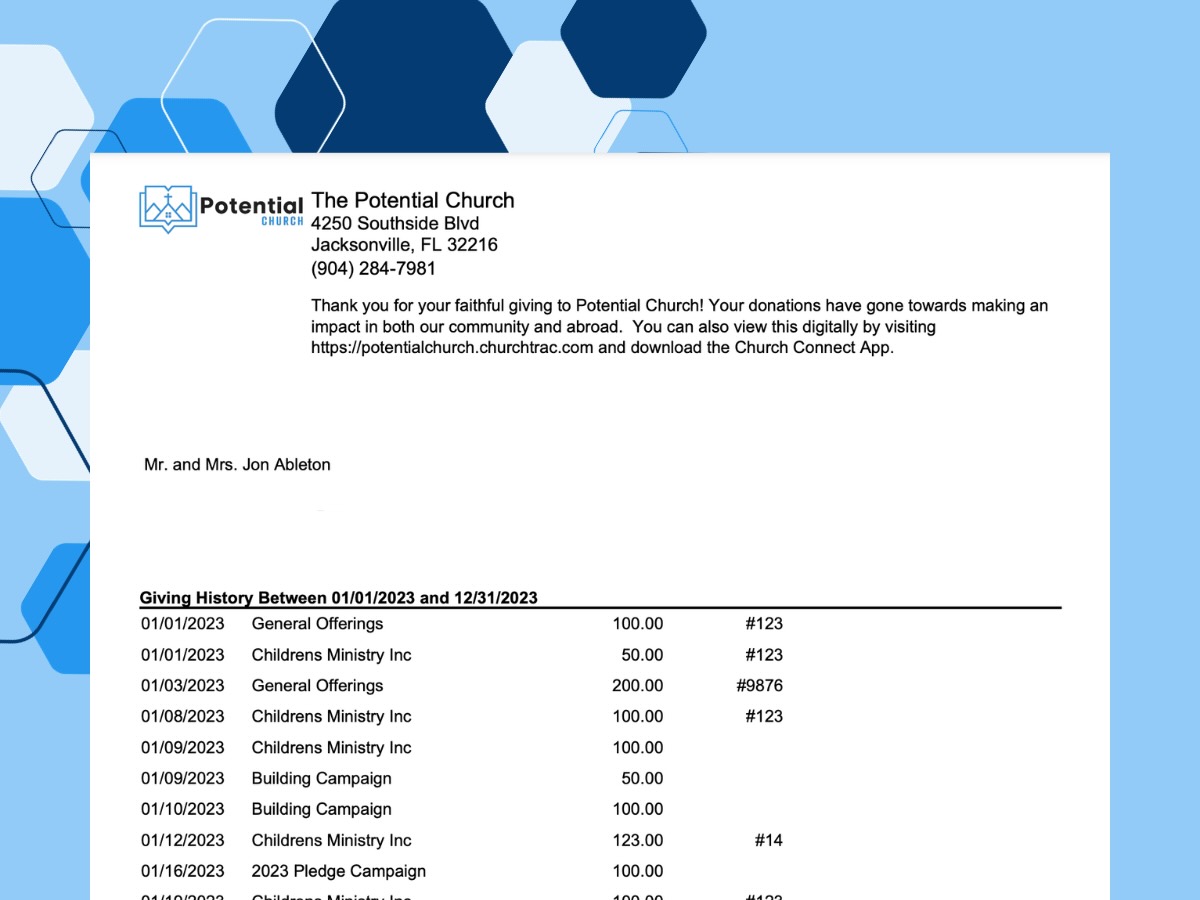

The best way to create a donation receipt is to record all donations throughout the year in your church giving software. This allows you to track your income throughout the year, while also preparing you to produce the donation receipts for tax season easily.

At the end of the year, log into your church contribution software and generate a report that displays every donation made by each donor. As long as the report has the details listed in the "What Information Should Be Included In A Donation Receipt" section above, this report will be your donation receipt.

Before producing your donation receipts, provide donors with the chance to update their address and contact information. That way, you can guarantee that these documents are sent to the right place.

The easiest way to get year-end donation receipts into the hands of your supporters is via email. Your church donation software should give you the ability to both produce these documents and send them to each donor in an email right from your account.

However, the best practice for delivering year-end donation receipts is to both email and print these statements to put in the mail. That way, your church makes sure everyone gets their document.

The Best Church Giving SoftwareChurchTrac Giving has everything you need to make donation receipts as easy as it should be. And our online giving fees are the lowest in the industry!

![]()

While every donation helps your church accomplish its mission, not all donations are created equal! Different types of donations have unique requirements for how you record them.

In-kind donations are added to the donation receipt just like cash donations. However, there is one key difference regarding how you record these donations.

When recording in-kind donations, you must enter the amount as $0. You CANNOT list the market value of the item in the receipt. It is up to the donor to know the market value of the item and write that off on their taxes.

All you need to do is label the donation as in-kind, then leave a note or memo that mentions the item(s) the donor provided. That's all the donor needs to make a tax deduction.

Watch this video where we cover everything about in-kind donations, especially best practices for handling in-kind donations:

In addition to the donor's name, a donation receipt needs to display the date and amount of the donation, as well as the donation category. If the donor used a check for the donation, include the check number. A note or memo won't be necessary for most donations but should be included when more details are necessary, as with in-kind donations.

The best way to record multiple donations from the same donor is to have donation software that allows you to create a profile for that donor to track their donations over time.

This allows you to apply every donation they make to their profile, making it easier to see how much they have donated and to produce a donation receipt that lists every single donation that they have made over the past year (or whatever time period you need to review).

Donation receipts are more than a year-end chore for you and your team. They're an effective way to show how much you appreciate your donors and build their confidence in your ministry!

By following this complete guide, you can ensure that your documentation meets the requirements for your donors to file their taxes and continue supporting your ministry for years to come.

Matt

Church Engagement